Eitc 2025 California State. On july 10, 2025, california adopted senate bill (sb) 131 to update requirements for employers to notify their employees that they may be eligible for the. The california earned income tax credit, commonly known as the caleitc, is a refundable tax credit that provides economic support to californians with low incomes and helps individuals and families pay for.

The young child tax credit (yctc) provides up to $1,117 per eligible tax return for tax year 2025. The eitc for tax year 2025 (filing by april 2025) ranges from $2 to $7,830.

California adopted senate bill (sb) 131, which updates the requirements for employers to notify their employees that they may be eligible for the earned income tax credit (eitc).

Eitc Notice Requirements By State 2025 Bev Rubetta, The california eitc is treated in the same manner as. Use our eitc calculator or review the 2025 caleitc credit table to calculate how much you may get when you file your tax year 2025 return.

How much is the EITC in California for 2025?, Earned income tax credit (eitc) rate (fully refundable): California adopted senate bill (sb) 131, which updates the requirements for employers to notify their employees that they may be eligible for the earned income tax credit (eitc).

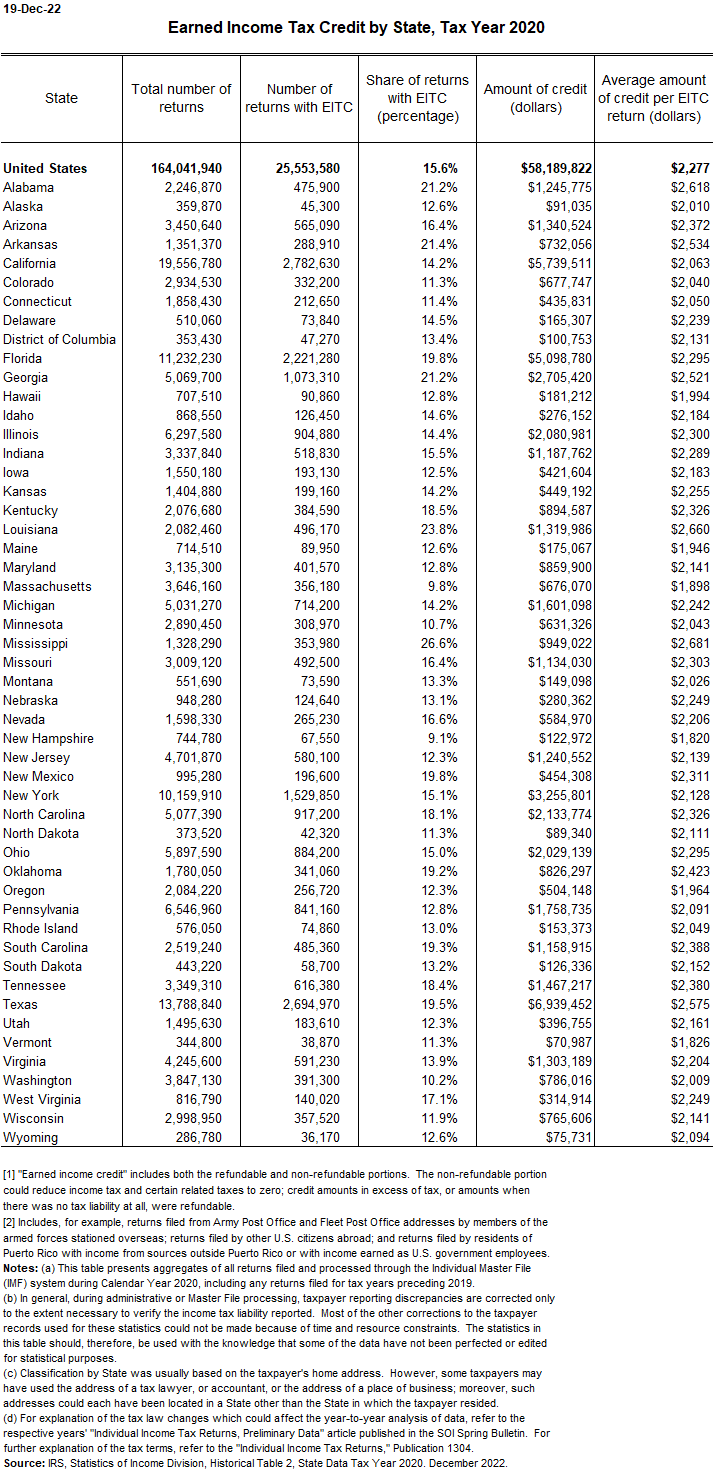

California and Federal Earned Tax Credit, The district of columbia, illinois, maine, maryland, new mexico, oregon,. On july 10, 2025, california adopted senate bill (sb) 131 to update requirements for employers to notify their employees that they may be eligible for the.

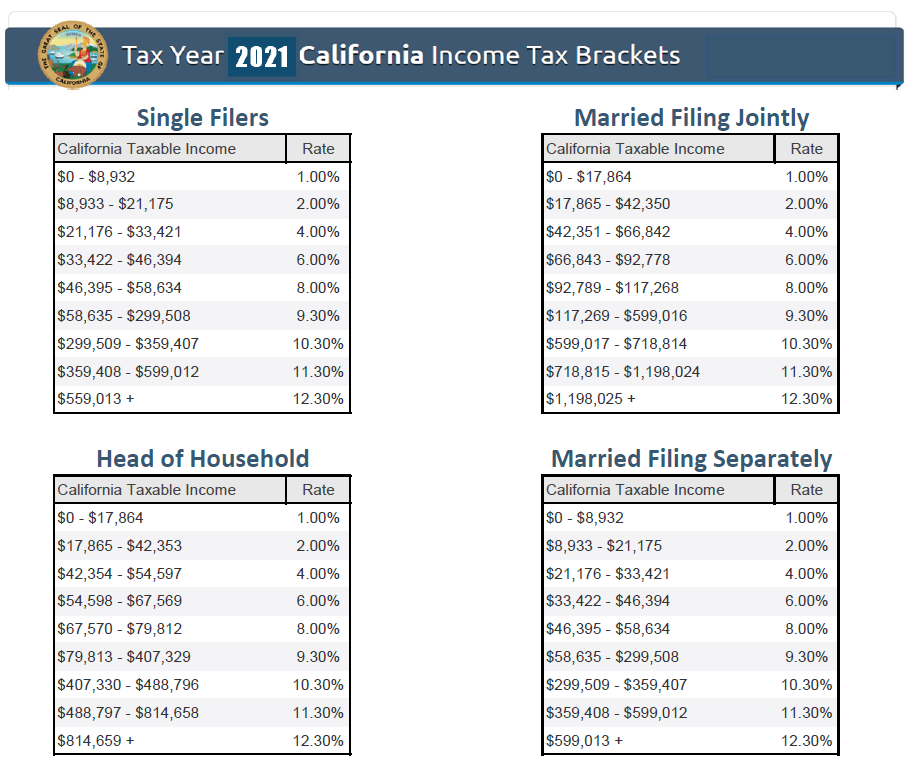

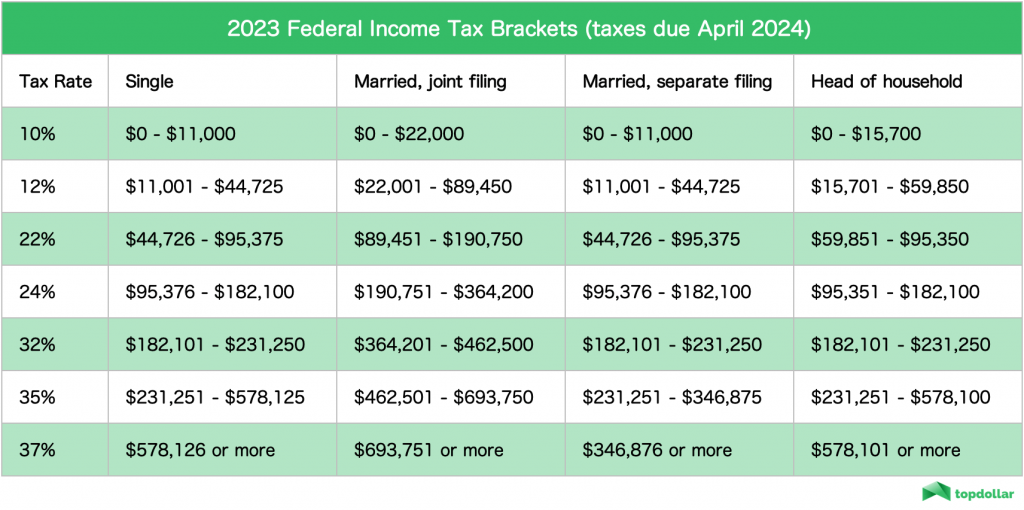

Tax Brackets 2025 Married Jointly California Withholding Fifine Noelani, The 2025 tax rates and thresholds for both the california state tax tables and federal tax tables are comprehensively integrated into the california tax calculator for 2025. 23 in america's top states for business for 2025.

Eitc Limit 2025 Zora Annabel, California has enacted legislation that significantly expands a requirement for employers to notify employees about federal and state earned income tax credits. Have a valid individual taxpayer identification number.

California Federal Tax Extension 2025 Rici Verena, The 2025 tax rates and thresholds for both the california state tax tables and federal tax tables are comprehensively integrated into the california tax calculator for 2025. The young child tax credit (yctc) provides up to $1,117 per eligible tax return for tax year 2025.

California Earned Tax Credit Letter, On july 10, 2025, california adopted senate bill (sb) 131 to update requirements for employers to notify their employees that they may be eligible for the. 85% of the federal credit for those earning up to $30,000.

What Is California State Tax Rate 2025 Cati Mattie, 85% of the federal credit for those earning up to $30,000. To receive the state credit, your investment income must be $4,525 or less in 2025.

Eitc 2025 Release Date Donna Gayleen, On july 10, 2025, california adopted senate bill (sb) 131 to update requirements for employers to notify their employees that they may be eligible for the. Yctc may provide you with cash back or reduce any tax you owe.

When Will Eitc Be Released 2025 Felice Kirbie, The district of columbia, illinois, maine, maryland, new mexico, oregon,. Use our eitc calculator or review the 2025 caleitc credit table to calculate how much you may get when you file your tax year 2025 return.